Megan Bailey provides insights into emerging trends in cryptocurrency as of Thursday, January 22, 2026 at 12:09 AM, focusing on potential candidates for significant growth.

Identifying the next cryptocurrency to explode involves thorough analysis of market trends, evolving technologies, and the macroeconomic landscape. Understanding investor sentiment, blockchain developments, and community engagement plays a crucial role in making informed predictions. Successful cryptocurrency investments often require a proactive approach, ongoing education, and risk management strategies.

Recent research indicates that approximately 42% of cryptocurrencies have underperformed compared to Bitcoin over the past five years (industry audits). Evaluating historical data and current trends can help potential investors narrow their choices to cryptocurrencies that exhibit robust fundamentals and vibrant communities.

Market Trends Analysis

Market trends in the cryptocurrency sector are influenced by several factors, including regulatory developments, technological advancements, and investor psychology. Monitoring price movements, trading volumes, and social media sentiment can offer insights into potential explosive growth opportunities.

When assessing market trends, it is essential to consider macroeconomic factors such as inflation, interest rates, and global economic conditions. These elements can impact overall market sentiment and, consequently, cryptocurrency valuations. Keeping an eye on market cycles can enhance readiness to seize investment opportunities. Megan Bailey provides insights into

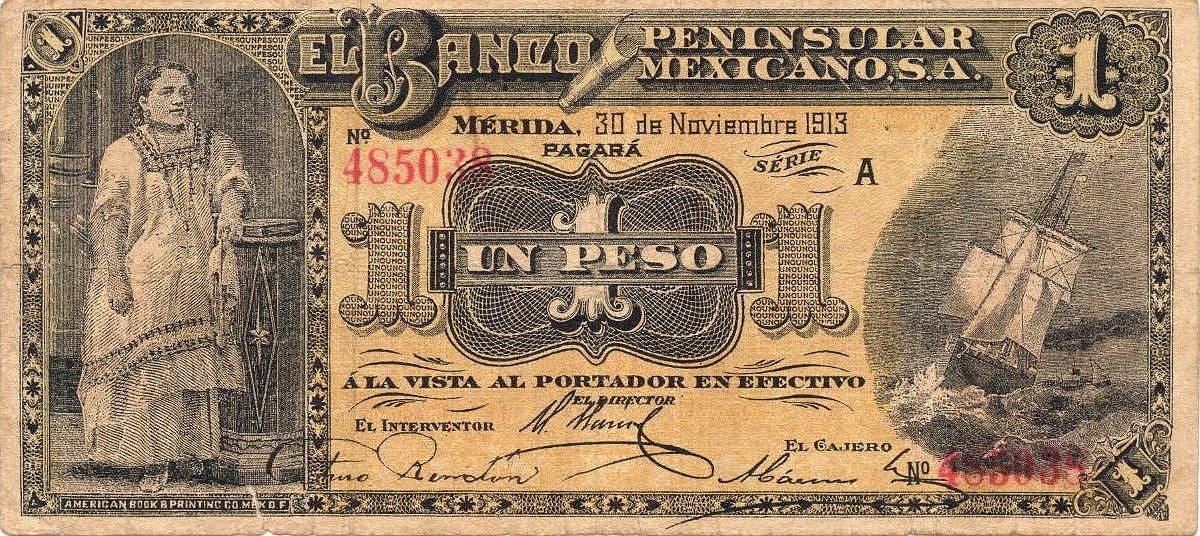

This image illustrates the various factors influencing cryptocurrency market trends and the dynamics of investor behavior.

Technological Developments

Technological advancements significantly impact the cryptocurrency landscape. Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-2 solutions are expanding the use cases for cryptocurrencies, thereby driving demand. Evaluating the technological underpinnings of a cryptocurrency can help determine its potential for explosiveness.

Cryptocurrencies that prioritize scalability, security, and usability are more likely to attract a broad user base. Assessing ongoing development activity and community engagement can provide insights into the viability of a cryptocurrency project. In practice, established projects with strong development teams and active communities often outperform others.

This visual represents the importance of technological advancements in shaping the future of cryptocurrency investments. Identifying the next cryptocurrency to

The process of identifying the next cryptocurrency to explode requires careful consideration of market dynamics and technological timelines. Here are key steps to ensure preparedness:

1. Conduct market research to identify potential cryptocurrencies with growth potential.

2. Analyze historical performance data and market trends.

3. Evaluate the technological foundation and use cases of chosen cryptocurrencies.

4. Monitor news and regulatory changes affecting the cryptocurrency ecosystem.

5. Assess investor sentiment through social media platforms and trading volumes.

6. Diversify investments across cryptocurrencies to hedge risks.

7. Establish a clear entry and exit strategy based on market conditions.

Various cryptocurrencies present unique opportunities for investment, but they come with inherent risks.

The effectiveness of seeking the next crypto to explode may diminish in specific contexts. Highly speculative investors focusing solely on short-term gains may find this strategy unsuitable. Additionally, in rapidly changing markets, less recognized or newly launched cryptocurrencies may be vulnerable to extreme volatility without established credibility.

1. Less experienced investors may overlook the necessity for comprehensive research, leading to uninformed decisions.

2. The absence of regulatory clarity can amplify risks associated with investing in newly emerging cryptocurrencies.

3. Time-limited opportunities may create financial pressure, causing rash investment decisions. Successful cryptocurrency investments

Considering these factors can enhance decision-making and reduce potential pitfalls in the cryptocurrency investment journey.

Performance Metrics

Evaluating the performance metrics of various cryptocurrencies can provide insights into their potential to explode in value. Metrics such as market capitalization, trading volume, and historical price trends can help gauge investor interest and overall market health.

| Metric | Definition | Significance |

|———————-|——————————————————–|————————————-|

| Market Capitalization | Total value of a cryptocurrency in circulation | Indicates overall market standing |

| Trading Volume | Total amount of a cryptocurrency traded over a period | Reflects investor interest and activity |

| Historical Volatility | Price fluctuations over a set timeframe | Assesses risk associated with the investment |

Understanding these metrics can assist investors in identifying promising cryptocurrencies while mitigating risks. Leading transactions volumes often correlate with increased awareness and acceptance, suggesting potential for explosive growth.

In conclusion, while predicting the next cryptocurrency to explode involves various analytical approaches and tools, it requires continuous engagement with market developments and emerging technologies. Investors must approach this landscape with a well-defined strategy, balancing speculation with sound fundamentals.

By staying informed and adopting a disciplined investment philosophy, individuals may position themselves to capitalize on the rapid growth opportunities characterizing the cryptocurrency space. For those ready to explore, conducting robust research and embracing the evolving market is crucial. The journey into the world of cryptocurrencies promises both challenges and rewards for those prepared to navigate it thoughtfully.

How can I identify promising cryptocurrencies for potential growth?

Look at cryptocurrencies with strong fundamentals, such as a solid development team, a well-defined use case, and significant community engagement. Analyzing market trends and technology advancements can also provide insights, but remember that high volatility and speculative trading can lead to rapid price fluctuations. However, this introduces tradeoffs that must be evaluated based on cost, complexity, or network conditions.

In what scenarios might I use a cryptocurrency that is seeing a price increase?

You might use such a cryptocurrency for investment diversification, hedging against inflation, or to facilitate transactions in specific decentralized applications. However, it's crucial to ensure that the coin's transaction fees and processing speeds align with your intended use.

How do new cryptocurrencies compare to established ones like Bitcoin and Ethereum?

New cryptocurrencies may offer innovative features or applications that established coins do not, but they often lack the security, market stability, and widespread acceptance that comes with Bitcoin and Ethereum. Additionally, newer projects may have less proven track records, which can influence risk assessment. However, this introduces tradeoffs that must be evaluated based on cost, complexity, or network conditions.